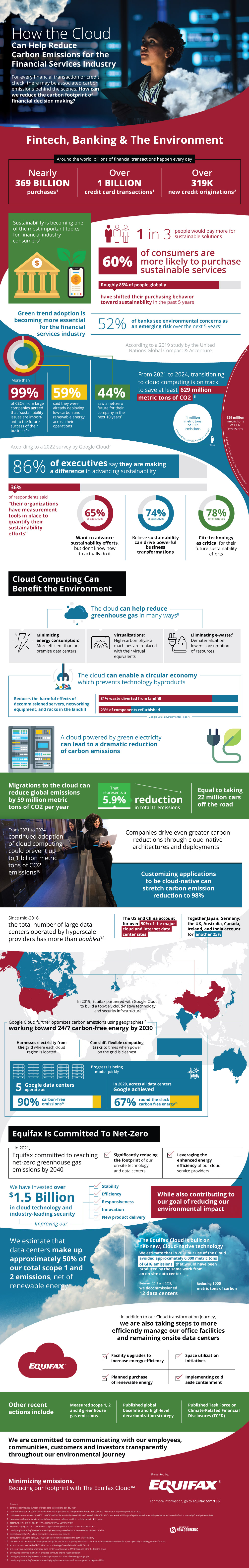

Around the world, billions of financial transactions happen every day. For every financial transaction or credit check, there may be associated carbon emissions polluting behind the scenes. Adoption of sustainable, cloud computing strategies is becoming more essential for the financial services industry, as more than half of banks see environmental concerns as an emerging risk over the next 5 years.

One part of the solution is cloud computing. From 2021 to 2024, the transition to cloud computing is on track to save at least 629 million metric tons of carbon dioxide. How does the cloud reduce greenhouse gasses? First of all, it uses energy more efficiently than on-premise data centers. Second, it replaces high-carbon physical machines with their virtual equivalents. Finally, dematerialization limits e-waste and lowers consumption of resources. The cloud can enable a circular economy which prevents technology byproducts from entering the landfill in such large numbers.

When the cloud servers are powered by green energy, the benefits compound even further. Because cloud servers can be located anywhere in the world, one can take advantage of geographies with the cleanest energy grids. It is also possible to shift flexible computing tasks to times when the energy grid is its most renewable.